Political Shift to Republicans Drive $407M Digital Asset Inflows

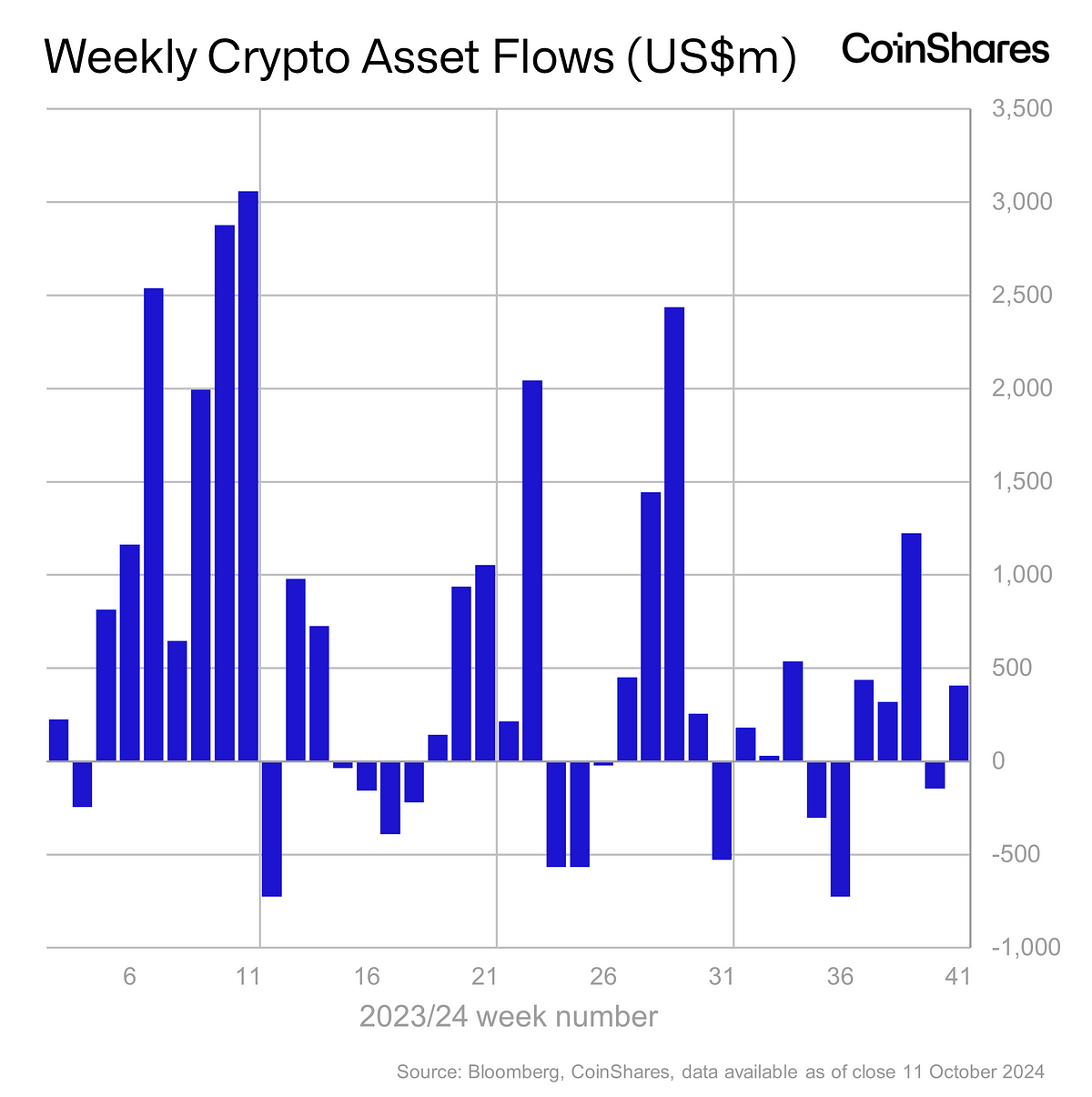

- Digital asset investment products saw inflows of US$407m, as investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks.

- Bitcoin saw inflows totalling US$419m, making it the primary beneficiary of recent political shifts.

- Blockchain equity ETFs saw one of the largest weekly inflows this year, totalling US$34m, likely in response to recent Bitcoin price rises.

Digital asset investment products saw inflows of US$407m, as investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks. This trend is evident in the fact that stronger-than-expected economic data had little impact on stemming outflows, whereas the recent US vice presidential debate and a subsequent shift in polling towards the Republicans, perceived as more supportive of digital assets, led to an immediate boost in inflows and prices.

As anticipated, likely due to the political nature of the recent inflows, the US accounted for US$406m, while the only other country with notable inflows was Canada, which recorded US$4.8m.

Bitcoin saw inflows totalling US$419m, making it the primary beneficiary of recent political shifts. In contrast, short-Bitcoin investment products saw outflows of US$6.3 million.

Multi-asset investment products saw their 17th week of inflows, although minor at US$1.5m. While Ethereum resumed its trend of outflows, which totalled US$9.8m last week.

Blockchain equity ETFs saw one of the largest weekly inflows this year, totalling US$34m, likely in response to recent Bitcoin price rises.

To access all our research click here.

To see the full detail report, click here.